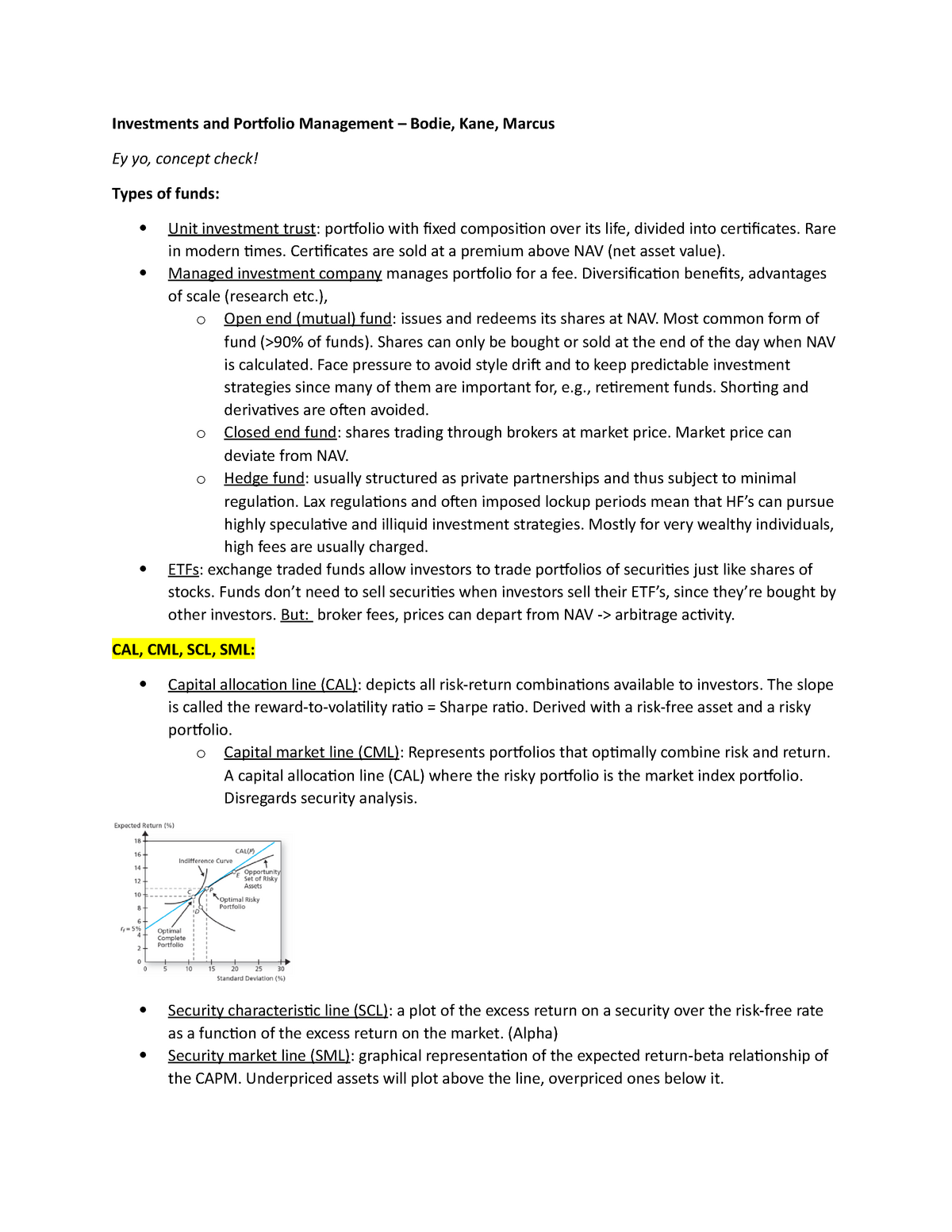

The cml contains only efficient portfolios (and plots return against volatility Am i right concerning this statemtns? The intercept point of cml and efficient frontier would result in the most efficient portfolio called the tangency portfolio. Cml is responsible for showing the rates of return for the portfolio that is being checked while the sml is responsible for knowing the risk of the market. The sml is just the term of the cml referred to in the capm model. Cml is a special case of the cal where the risk portfolio is the market portfolio. The graphs look virtually identical, the assumptions under which. This is also a line in the graph determining your rate of return but. The cml contains only efficient portfolios (and plots return against volatility The intercept point of cml and efficient frontier would result in the most efficient portfolio called the tangency portfolio. The sml essentially graphs the results from the capital asset pricing model (capm) formula. Would you buy these shares at current market price? The sml is just the term of the cml referred to in the capm model. Want to read all 32 pages? Cml stands for capital market line. Sml stands for security market line.īm 410 Investments Capital Asset Pricing Theory And from This is also a line in the graph determining your rate of return but. Tags capital asset pricing model, cml, sml.

Learn vocabulary, terms and more with flashcards, games and other study tools. Graphical representation of the notion embodied in the capm, that expected asset returns are the sml is a simple tool for determining whether an asset offers reasonable expected return for the.

Capital market line (cml) is determining the the equilibrium relationship between the total risk and. Sml Vs Cml | Would you buy these shares at current market price? Cml is a special case of the cal where the risk portfolio is the market portfolio.

0 kommentar(er)

0 kommentar(er)